FoQus

Relevanz. Expertise. Können.

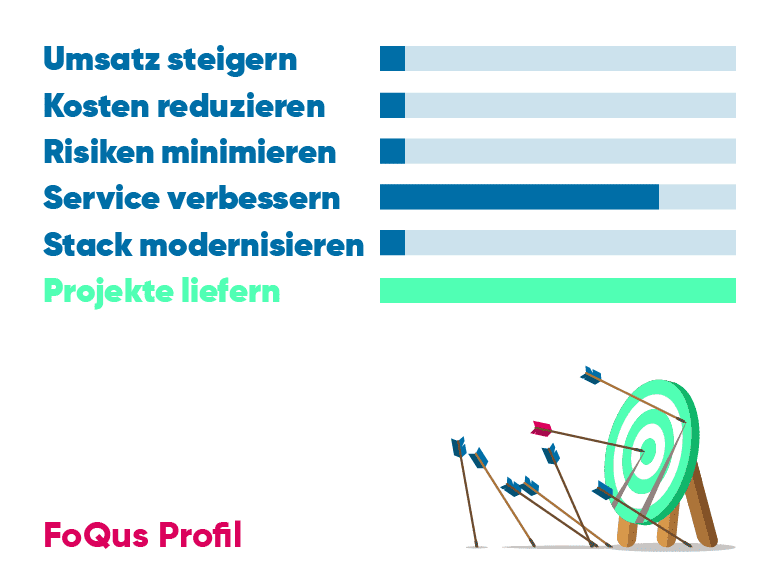

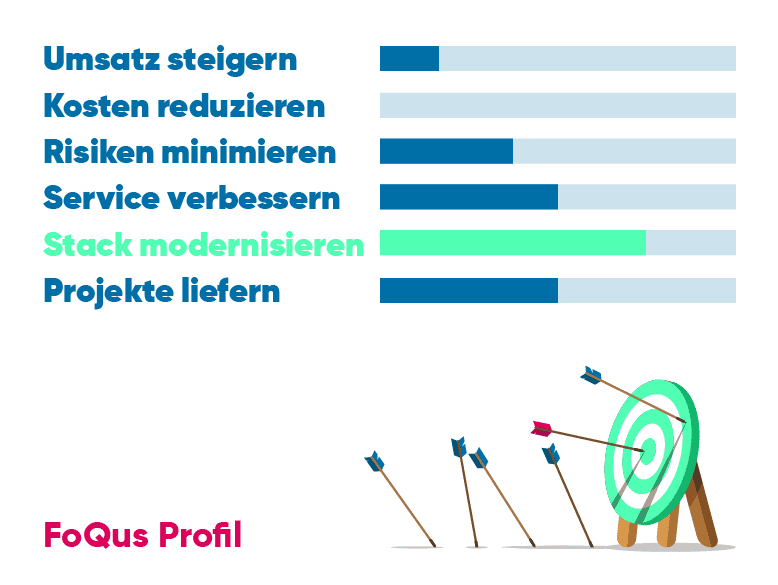

abaQon bietet Know-how und Erfahrung in einigen der relevantesten Entwicklungsbereiche des Bankwesens. Wir präsentieren diese als unsere FoQus Themen, welche durch ein durchgängiges Dienstleistungsportfolio, nachweislich erfolgreiche Ergebnisse sowie eine klare Positionierung gekennzeichnet sind.

FoQus 03.06.2025

Generative KI im Banking

Generative KI revolutioniert die Art und Weise, wie Unternehmen Innovationen vorantreiben können. Wir unterstützen unsere Kunden dabei, Potenziale für die Implementierung generativer KI zu erkennen, massgeschneiderte Lösungen zu konzipieren und diese erfolgreich umzusetzen.

Die rasante Entwicklung generativer KI eröffnet Unternehmen ungeahnte Möglichkeiten zur Kostensenkung, Prozessoptimierung und Verbesserung des Kundenservice. KI-Agenten, gestützt auf Large Language Models (LLMs), eröffnen enormes Automatisierungspotenzial, das durch strategisches Vorgehen effizient genutzt werden kann. Doch der dynamische Fortschritt erfordert umfassende Expertise – nicht nur in Bezug auf die vielfältigen Einsatzmöglichkeiten, sondern auch hinsichtlich Datenschutz, Akzeptanz und der nahtlosen Integration in bestehende Systeme.

Wir begleiten unsere Kunden auf diesem Weg und helfen ihnen, die Chancen der generativen KI zu nutzen und gleichzeitig die obengenannten Herausforderungen zu meistern. abaQon bietet Kunden Orientierung, wirkt unterstützend und setzt Projekte um, die auf generativer KI basieren, indem:

- Eine Standortbestimmung gemacht wird, um potenzielle Use Cases für den Einsatz generativer KI zu identifizieren

- Durch das Erarbeiten von Prototypen Potenziale aufgezeigt werden, der Proof-of-Concept erbracht wird, Corporate Buy-in generiert sowie die Ausarbeitung des Proof-of-Values unterstützt wird

- Produktive Lösungen konzipiert und erfolgreich implementiert werden

Schweizer Universalbank – Rapid Prototype Development für die generative KI-Plattform einer renommierten Schweizer Universalbank:

In Zusammenarbeit mit unserem Kunden wurden vielversprechende Use Cases für die Anwendung generativer KI identifiziert und hinsichtlich potenziellen Mehrwerts analysiert und priorisiert. In einem nächsten Schritt wurden funktionsfähige Prototypen entwickelt, um den Proof-of-Concept zu erbringen und die Kernfunktionen für die identifizierten Use Cases zu testen. Die gewonnenen Erkenntnisse durch die Entwicklung der Prototypen und durch deren Testen mit zukünftigen Nutzern wurden genutzt, um den Proof-of-Value zu erbringen und einen Business Case zu erstellen. Weiter wurden die Prototypen genutzt um den Corporate Buy-in zu fördern, das Potenzial solcher Lösungen zu kommunizieren und das Ziel der produktiven Implementation voranzutreiben.

Schweizer Universalbank – Fachliche Projektleitung bei der produktiven Implementierung einer generativen KI-basierten Lösungen für die vereinfachte Bereitstellungen regulatorischer Informationen für die internen Mitarbeiter:

Die regulatorische Landschaft für Schweizer Banken hat in den letzten Jahrzehnten enorm an Komplexität und Umfang zugenommen. Die vereinfachte Bereitstellung und Erklärung von regulatorischen Inhalten durch die Nutzung generativer KI wurde deshalb als Lösung mit grossem Mehrwert für interne Mitarbeiter identifiziert. Für die Lösungsumsetzung wurde in Zusammenarbeit mit der internen IT eine auf Retrieval Augmented Generation (RAG) basierende Lösung entwickelt.

FoQus 01.01.2024

Data Protection

Von Konzepterarbeitung, über Definition der Prozesse und strukturierte Analyse der Systeme, begleiten wir unsere Kunden als «Market Leader» bei der Implementation von DSG-konformen Löschvorgängen.

Der absehbare Nachzug von EU-DSGVO in der Schweiz wird die Anforderungen des Gesetzgebers und die Erwartungen der Kunden an die Banken in den datenschutzrechtlichen Aspekten steigern. Eine der wichtigsten Anforderungen der neuen Regulierung betrifft die Löschpflicht, und fordert die Banken personenbezogene Daten periodisch zu löschen.

- Wir verfügen über ganzheitliche DSG-Analyse Kompetenz und sind in der Lage, die regulatorischen Anforderungen auf technische und organisatorische Anforderungen zu übersetzen.

- Wir begleiten unsere Kunden in der Konzeption, Implementation und Orchestrierung der Löschvorgänge in Avaloq und im Kontext der gesamten Applikationslandschaft (inkl. Risk-Scoring und Priorisierung der Systeme).

- Mittels eines firmeneigenen Tools analysieren wir alle Objekt-Relationen, um in Avaloq alle personenbezogenen Daten löschen zu können, bei gleichzeitiger Sicherung der aufbewahrungspflichtigen Daten-Konstellationen.

- Gestützt auf fundierte Kenntnisse des Avaloq Objekt Models und Best-Practice Erfahrung, führt das abaQon Data Protection Team eine Reihe von Validierungsworkshops mit der Bank durch und begleitet die Test-Kampagne, bevor Daten unwiderruflich aus den produktiven Umgebungen vernichtet werden.

Britische Privatbank –DSGVO Prozesse und Datenlöschung

Wir haben die erste Avaloq Bank bei der Implementation der Datenlöschung vom Konzept bis zur ersten produktiven Ausführung begleitet. Neben der leitenden technischen Rolle haben wir die Bank bei der Gestaltung der neuen DSGVO-Prozesse, Folgenabschätzungen und Weisungen für Datenschutz freundliche Voreinstellungen unterstützt.

Kantonalbank 1 – Implementation der Datenlöschung in Avaloq

In der Analyse Phase haben wir zusammen mit den Abteilungen Rechtdienst und IT-Sicherheit das Zielbild definiert. In der Implementation haben wir die leitende technische Rolle für Avaloq übernommen und die Synchronisierung der Löschung mit den Umsystemen sichergestellt.

Kantonalbank 2 – Konzeption der Datenlöschung

Analyse der Rechtsvorschriften und Weisungen sowie Erstellung von einem fachlichem Löschkonzept.

FoQus 01.01.2024

Effizientes Projekt-management mit Jira & Confluence

Jira & Confluence ist ein Softwarepaket für agile Projekte, das es ermöglicht, Requirements Engineering, Delivery und Bugfixing zu strukturieren und zu verwalten. Unsere Erfahrung und daraus abgeleitete Best Practices ermöglichen es unseren Kunden, dies effizient und effektiv zu nutzen.

Finanzdienstleister verwalten zunehmend mehrere komplexe Projekte gleichzeitig. Dabei kommt häufig die Methodik zu kurz und es fehlt an cleveren Standards für das Tracking der Requirements, der Entwicklung oder der Bugs sowie für das Reporting und die Projektplanung. Wenn diese jedoch von Anfang an überlegt und konsistent definiert und umgesetzt werden, bilden sie die Basis für den Projekterfolg.

Dank der Erfahrungen aus verschiedensten Projekten und unserer Kenntnisse der Funktionen und Plug-ins können wir unseren Kunden hands-on Expertise anbieten.

Wir können dabei unterstützen, Jira & Confluence zu Projektbeginn richtig einzurichten und eine klare Methodik einzuführen

Wir unterstützen auch bei der Durchführung von Turnarounds helfen, für Ordnung und Übersicht zu sorgen.

British Private Bank – Management der „Ways of Working“ für ein Programm bestehend aus 4 Projekten mit insgesamt >150 Projektmitgliedern

Mit dem Ziel, nicht nur die Integrationsarchitektur der Bank zu modernisieren, sondern auch ein neues Online-Banking-System für mehrere Legal Entities zu entwickeln und einzuführen, stand die Bank vor einer Herausforderung bei der Verwaltung dieser gross angelegten Transformation, an der mehrere Anbieter und Teams verteilt über Europa und Indien beteiligt waren. abaQon entwickelte iterativ die agile Methodik des Programms, schuf Standards für Jira und Confluence und kommunizierte diese an alle Mitglieder. Vor allem aber programmierten wir Advanced Reports, Dashboards und gross angelegte „Jira Structures“, um die Tausenden von Epics, Stories und Bugs überschaubar, nach Prioritäten geordnet und jederzeit kommunizierbar zu halten.

FoQus 01.01.2024

Marketing Automation

Personalisierte Kundenansprache und effiziente Prozesse. Mit Expertise in der Konzeption und Integration von komplexen Vertriebsvorhaben, unterstützt abaQon bei der Digitalisierung von Vertriebs- und Leadprozessen.

Der verschärfte Wettbewerb, die anhaltende Margenerosion sowie die steigenden Kundenansprüche zwingen Banken zu einem Umdenken. Kundenzentrierung muss zum Kern der Strategie werden und der Kunde mit seinem Bedarf muss in den Fokus gerückt werden. Marketing Automation hilft dabei den Kunden gemäss seinen Präferenzen auf der individuellen Customer Journey abzuholen und effizient zu bedienen.

- Digitale Vertriebs-Architektur: Analyse, Konzeption und Design von ganzheitlichen digitalen Vertriebsprozessen von den operativen Systemen, über die Analytik Infrastruktur, die Marketing Automation inkl. den Kundenkanälen bis hin zum CRM und der operativen Abwicklung.

- Lead Management: Konzeption und Integration von einem generischen Lead Management Konzept über die Systeme der Potenzialerkennung (Quellen), der Potenzialentwicklung (Automation) und deren Erschliessung (Kanäle).

- Workflow & Kanal Management: Konfiguration und Entwicklung von Marketing Automation Workflows, deren Daten Integrationsstrecken sowie die Implementation von Online Triggers und Tracking Codes auf digitalen Kanälen.

- Personalisierte Kundenansprache: Entwicklung von generischen Customer Journey’s inkl. deren Reduktion auf relevante Funktionen, Personalisierungsattribute, Content und Kanalpräferenzen.

Aufbau Marketing Automation bei einer Schweizer Bank

abaQon war verantwortlich für die Gesamtkonzeption, Prozessdesign und die Umsetzungskoordination der Marketing Automation Lösung. Im Fokus stand die Harmonisierung und Standardisierung der Lead Management Prozesse sowie die effiziente und transparente Gestaltung von Kampagnen Prozessen über die involvierten Systeme.

Durch personalisierte Kundenansprachen und automatisierte Prozesse in der Lead Entwicklung, konnten bis zu 20x grössere Zielgruppen über Kampagnen bedient und bis zu 3x höhere relative Abschlusswerte erzielt werden. Dies, ohne die Vertriebsabteilung zusätzlich zu belasten und ohne den Kundenberater zu übergehen.

Durch den standardisierten Lead Management Prozess wurden die vertrieblichen Aktivitäten nicht nur effizienter sondern durch das vertriebliche Reporting auch transparenter für alle involvierten Parteien.

FoQus 01.01.2024

Project Turnaround Management

Aufgrund langjähriger Erfahrung, ausgewiesener Kompetenz und einem bewährten Vorgehen zur Einleitung und Durchführung eines Turnarounds, helfen wir unseren Kunden, ihre Projekte auf die Siegesspur zurück zu bringen.

Immer wieder scheitern Projekte oder werden später und teurer geliefert als ursprünglich geplant. Dies verursacht hohe Kosten, frustrierte Mitarbeiter und nicht zuletzt auch hohe Risiken, wenn beispielsweise Regulatorische Anforderungen nicht rechtzeitig umgesetzt werden können. Jedes Projekt ist anders und jeder Turnaround erfordert massgeschneiderte Massnahmen.

- Die grösste Herausforderung ist es, den Zeitpunkt für die Einleitung des Turnarounds nicht zu verpassen. abaQon kennt verschiedene Wege, einen Turnaround einzuleiten. Neben drastischen Massnahmen, gibt es auch bewährte, schnellere Möglichkeiten, das erste Assessment ohne Zeit zu verlieren und grosses Aufsehen zu erregen in Angriff zu nehmen.

- abaQon verfügt über eine toolunterstützte, 3-phasige, aber trotzdem agile Turnaround Methodik, welche sich durch 9 Fokusbereiche, strukturierte & transparente Resultaterfassung und klar definierte Freigabeprozesse auszeichnet.

- In einem Turnaround Vorhaben sind verschiedene Kompetenzen gefragt. Vom ganzheitlichen, systemischen Denken im Assessment über Kreativität und Agilität bei der Erarbeitung von Massnahmen bis zu Durchhaltevermögen, Durchschlagskraft und einer Prise Humor bei der Korrektur. Die abaQon Turnaround Manager haben in zahlreichen erfolgreichen Projekt-Turnaround-Einsätzen bewiesen, über die notwendigen Kompetenzen zu verfügen.

Turnaround eines grossen Implementationsprojektes

Als Teil der neuen Projektleitung wurde ein Projekt mit weit über hundert Mitarbeiter durch Entschlackung, Neubesetzung von Schlüsselrollen und Etablierung einer bewährten Methodik in geordnete Bahnen gelenkt.

Turnaround einer Taskforce

Der Turnaround Manager wurde in einer Doppelrolle als Taskforce-PMO und als Leiter Entwicklungsteam eingesetzt. Nach Schaffung von Transparenz, Restrukturierung der Taskforce-Organisation und drastischer Reduktion des Scopes wurde das Ziel erreicht.

«Das Turnaround Team hatte enorme Durchschlagskraft, eindrückliches Durchhaltevermögen und das Projekt aus einer anhaltenden Lethargie befreit. Durch strikte Fokussierung auf Korrektur der jeweils kritischsten Befunde konnte das Projekt Schritt für Schritt auf den richtigen Weg gebracht werden». (Stimme des Kunden)

FoQus 01.01.2024

Process Mining

Dank unserer fundierten Kenntnisse mit Process Mining, ermöglichen wir Ihnen einen visuellen Einblick in die Effizienz Ihrer Prozesse, weisen Ihnen Optimierungspotential auf und messen den Erfolg der Veränderungen.

Um dem Margendruck und zunehmenden Wettbewerb gerecht zu werden, müssen Prozesse kontinuierlich effizienter werden. Die manuelle Messung and Analyse verursacht hohe Kosten, benötigt beachtliches Engagement von Experten und leidet häufig an der Verfügbarkeit von detaillierten Daten. Zudem muss der Messaufwand zwei Mal durchgeführt werden, vor und nach der Optimierung.

- Prozessübersicht: Durch die Kombination von strategischer Relevanz und technischer Voraussetzung, priorisiert abaQon ihre Hauptprozesse und empfiehlt geeignete Use Cases

- Proof of Concept: abaQon liefert Ihnen eine objektive Beurteilung der verfügbaren Lösungen und führt ein „Proof of Concept“ durch

- abaQon unterstützt Sie in der Identifikation und dem Export der benötigten Daten (Event Logs), definiert Meta-Daten und interpretiert die Resultate zu umsetzbaren Massnahmen

- Fehlt es an verfügbaren Daten oder Datenqualität, kann abaQon diese effizient mittels Task Mining aufzeichnen

- Evaluation: Basierend auf Ihrer Strategie und Infrastruktur, berät abaQon Sie bei der Evaluierung des passenden Tools für Ihre Bank

- Implementation: Nach erfolgreicher Pilotierung, bietet Ihnen abaQon ein Konzept zur bankübergreifenden Skalierung und nachhaltiger operativen Führung, damit Sie kontinuierlich Optimierungs- und Automatisierungspotential identifizieren und umsetzen können

Durchführung Proof of Concept (POC) & Evaluation

Wir verhalfen einer grossen Universalbank geeignete Prozesse (z.B. Call Center) sowie vier adequate Softwarelösungen zu identifizieren und in einem POC zu evaluieren. Die Bank nutzte die gewonnenen Erkenntnisse, um die Prozesse zu standardisieren und Subprozesse auf Basis der „Best Practice“ zu automatisieren. Unsere Empfehlung ermöglichte der Bank die Wahl einer bedarfsgerechten Software.

Einführung von Process Mining

Von der Roadmap über den Business Case hin zur operativen Einführung wurde eine Regionalbank von uns begleitet und beraten. Nach dem einmaligen Aufwand zur Aufsetzung der Dashboards, konnten die Führungskräfte der involvierten Bereiche regelmässig Abweichungen und Unregelmässigkeiten erkennen und entsprechende Schritte zur Optimierung einleiten.