THE PROJECT

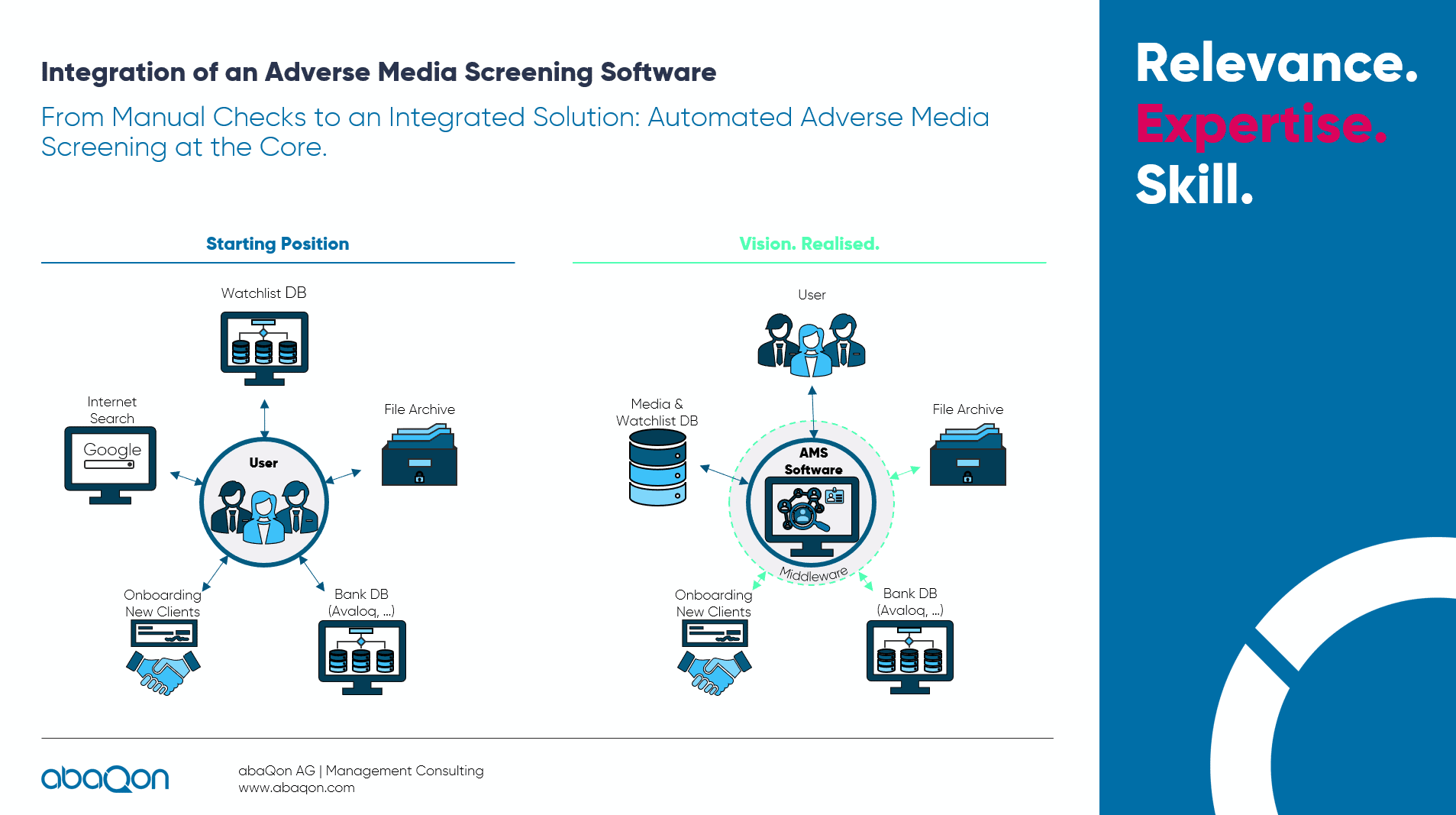

An international private bank previously used a largely manual process to check its clients for potential reputational risks and sanctions. The screening process included time-consuming web searches that analysed a large number of unstructured data sources such as newspaper reports and press releases. This approach often led to confusing results and limited quality assurance, as public search engines do not offer access to proprietary media databases. In addition, new regulatory requirements in the area of adverse media screening aggrevated the need to expand existing processes and data sources. To meet these challenges, the bank decided to introduce the Labyrinth Screening software solution from Ripjar, which can handle the screening of natural and legal persons comprehensively and automatically.

OUR CONTRIBUTION

abaQon supported the bank from the selection of the software provider throughout the complete integration of the adverse media screening software into the existing system landscape to the global rollout to users. Our experts developed concepts for end-to-end processes, user management and data security and took responsibility for implementing all regulatory requirements. As part of the integration, abaQon developed customised workflows, microservices for connecting external systems and created comprehensive reporting. In addition, abaQon acted as an intermediate between the bank and the software provider, ensuring smooth project management.

REALISED ADDED VALUE

With the new screening software, the bank can ensure compliance with regulations and at the same time significantly increase efficiency in the KYC process. Automated workflows and seamless integration into existing systems lead to optimised procedures, while the improved data quality enables the bank and its employees to make a well-founded and comprehensible risk assessment.

Author

Jürg Käser, Manager

Project Lead