THE PROJECT

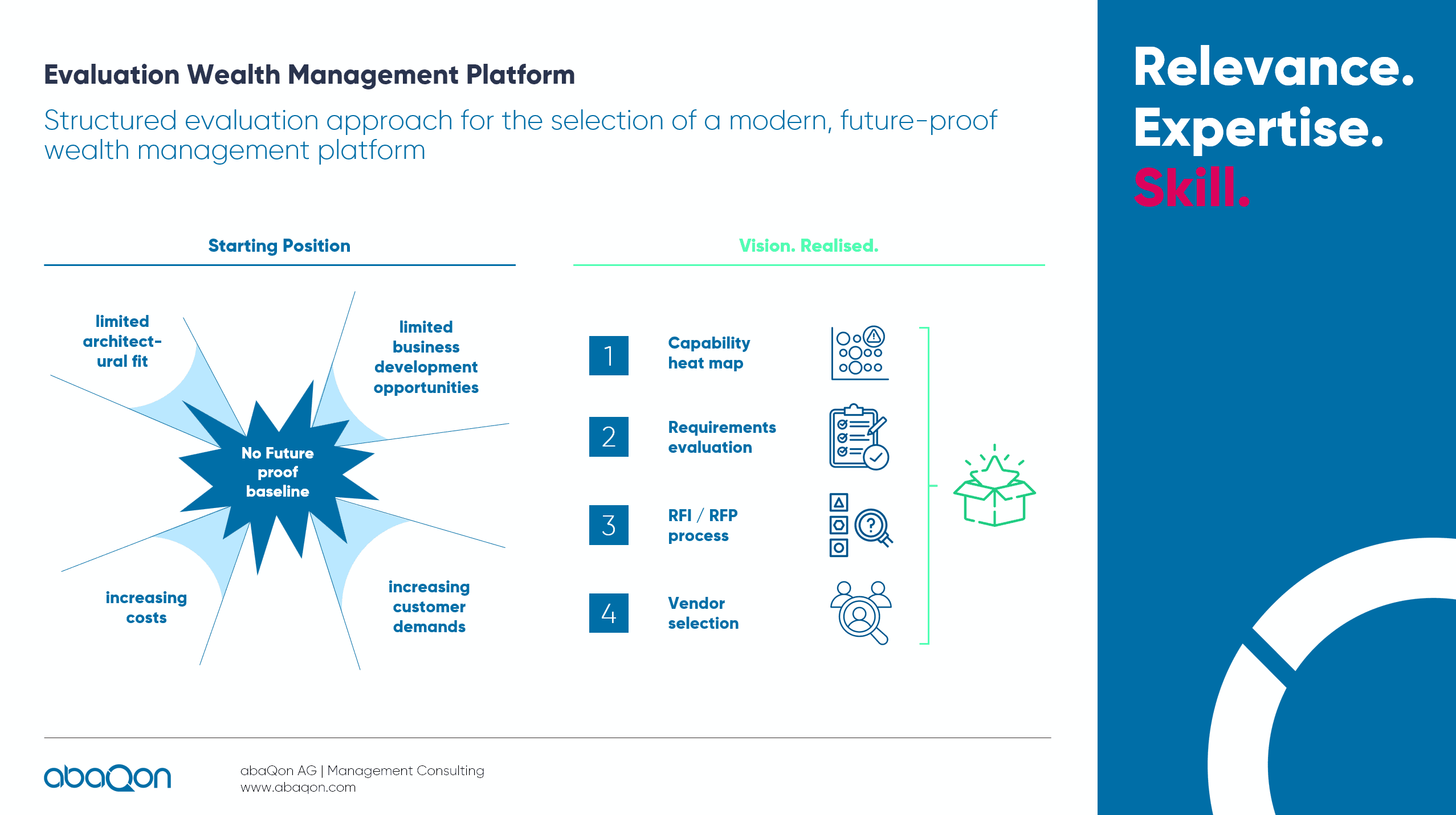

A major Swiss retail bank faced the challenge that its existing investment advisory solution was not future-proof and significantly limited the organization’s ability to develop its business. Rising operational costs, longer time-to-market for feature implementation, and the lack of support for hybrid requirements were just some of the limitations. The goal of the project was to identify and select a modern, future-ready wealth management platform capable of meeting both strategic and operational demands of the future.

OUR CONTRIBUTION

abaQon supported the assessment of current capabilities and identified gaps between the current state and future ambitions. Building on this, we collaborated with the client to develop a structured requirements and evaluation catalog. We further supported the organization in the RFI, RFP, and decision-making processes to identify the right solution and suitable provider.

REALISED ADDED VALUE

Through our structured approach, a modern, future-proof wealth management platform was identified that aligns perfectly with the company’s strategy and integrates seamlessly into the architectural landscape. This has laid a sustainable foundation for the future and provided systematic support for the further development of the investment business.

Author